Not known Facts About wills vs trust

Residue of your estate: The residue of your estate features all remaining property not presently supplied as unique items. In case you have named more than one beneficiary for your residue of your estate then your executor could have to offer your remaining property (in this instance, your motorboat, your cottage while in the nation, plus your inventory and bond holdings) and divide the cash equally among your remaining beneficiaries based on the shares you may have indicated.

The Trustee may well hold un-invested cash and unproductive property the place it is actually fair and in the best desire of the Living Trust to take action including, although not restricted to, for the goal of preserving the money and principal of this Residing Trust.

When you under no circumstances had to hunt any legal professional companies ahead of it could get quite overwhelming and this Web page created almost everything so much better.

Further tax return: An Irrevocable Trust will need to file a tax return, and there will usually be a price to arrange and file.

SmartAsset will not review the ongoing overall performance of any Adviser, get involved in the administration of any consumer’s account by an Adviser or provide advice pertaining to particular investments.

You wish to make sure that your residence is benefiting the charity you wish to reward. In addition, you'll have tax targets, and these ought to be tackled with the assistance of the LegalMatch trust attorney.

This document preview is formatted to fit your check here mobile machine. The formatting will modify when printed or considered over a desktop Pc.

Attain out to Trust & Will now to learn more about ways to generate an extensive, complete, concrete Trust as aspect of your Estate System. It’s the start from the legacy you’ll one day leave driving.

"The layout is apparently quick to comprehend and also to observe, with a clear and useful direction that can assist you have an understanding of Each and every segment of the procedure required in crafting a will. "..." a lot more

Designate a guardian to minimal youngsters. Your more info will should designate who will serve as the guardian to any small little ones, if applicable, during the function within your Loss of life.

This is meant for the goal of offering here the Grantor a effective fascination and possessor rights in the residence and to ensure that the Grantor does not get rid read more of any eligibility for just a condition homestead tax exemption that they might or else qualify for.

Commonly, if a person ended up to market house which includes absent up in benefit because it was obtained, they could must spend a money gains tax over the property. Nevertheless, In case the property is donated to some charitable trust, it would be probable to avoid paying out cash gains tax.

The Trustee might make use of and trust in the recommendation of specialists which include, although not limited to, authorized counsel, accountants and investment advisors to help you while in the administration in the Assets where by that employing is considered reasonable and in the very best Over-all interest of this Dwelling Trust.

Retail store the will safely and securely. Your will just isn't filed While using the courts till immediately after your Dying. In the event the will is destroyed, it can't be submitted. Be sure that you retail outlet the will somewhere that can be found right after your Dying.

Jake Lloyd Then & Now!

Jake Lloyd Then & Now! Andrea Barber Then & Now!

Andrea Barber Then & Now! Matilda Ledger Then & Now!

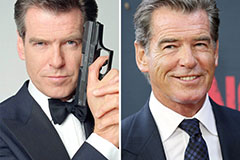

Matilda Ledger Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!